By Daniel Kelley and Hilary Russ

ATLANTIC CITY NJ/NEW YORK (Reuters) – It’s “premature” to talk about bankruptcy for troubled gaming resort Atlantic City, Detroit’s former turnaround expert said Thursday as he signed on with the latest bid to revive a city some see as bound to follow the path taken by the Motor City. Atlantic City’s lifeblood, gaming revenue, has been decimated as newer casinos in nearby states such as New York and Massachusetts lured gamblers away from the storied but downtrodden New Jersey shore locale. New Jersey Governor Chris Christie on Thursday appointed a turnaround team, including former Detroit emergency manager Kevyn Orr – a step the struggling casino town has resisted.

“There’s only one reason to hire Kevyn Orr after Detroit and that’s if you’re going into bankruptcy, said Tamara Lowin, Municipal Analyst at Belle Haven Investments.

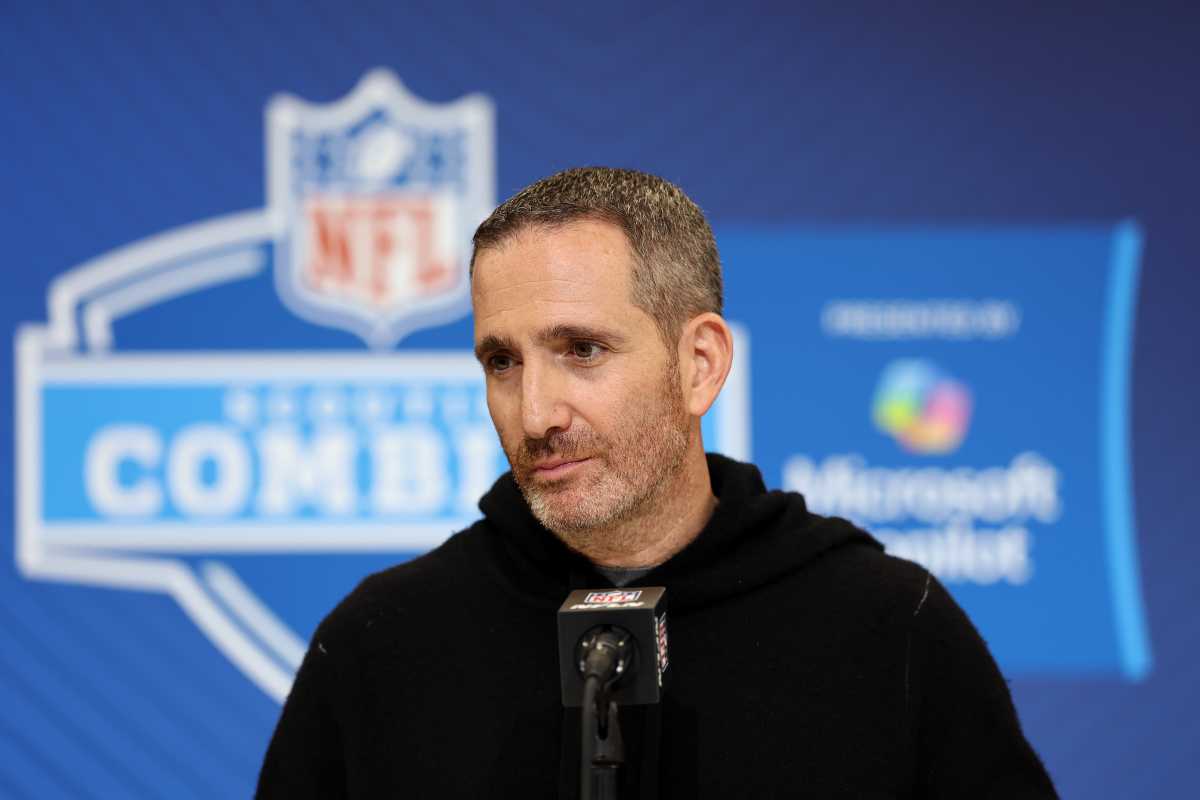

Christie, a potential 2016 presidential candidate, acknowledged multiple bipartisan attempts to get the city on firm financial footing, but said they had failed. All of those plans required significant state resources. “We are digging out of an enormous hole,” Christie said. “We have problems we have to fix… none of them are unfixable if in fact we have the political will to be able to get them done.” The team will be led by Emergency Manager Kevin Lavin, who previously worked for turnaround specialist FTI Consulting. Lavin is an expert in “delicate discussions with constituencies with different interests,” said John Rapisardi, a bankruptcy lawyer at O’Melveny & Myers, who has worked with him. Orr will support Lavin as special counsel. A former corporate bankruptcy lawyer at the firm Jones Day, Orr most recently guided Detroit through the biggest-ever U.S. municipal bankruptcy.

Orr said it was “premature” to talk about bankruptcy for the city, which must repay a $40 million bridge loan from the state by March 31. It would take about 90 days to implement a plan and another 90 days to see results, he said. Still, observers said that the appointment was a clear indication of direction.

“(New Jersey) does have a path to municipal bankruptcy in its statutes – given that, the appearance of Mr. Orr is surely making a impression on the municipal finance community,” said Melissa Jacoby, a law professor at the University of North Carolina. In New Jersey, a city must win permission from the Local Finance Board to file for Chapter 9 municipal bankruptcy.

“If Chris Christie is moving this forward then presumably that access wouldn’t be denied,” said bankruptcy lawyer Michael Sweet.

The appointment of an emergency manager was rejected by Atlantic City lawmakers earlier this month as they endorsed steep budget cuts.

“I’m not in support of it, but if we do get an emergency manager, I’ll work with him,” said State Assemblyman Vince Mazzeo, who represents Atlantic City, ahead of the announcement. There were, however, doubts that Orr can work magic on a city that saw four of its 12 casinos close in 2014. A fifth, Trump Entertainment’s Taj Mahal, narrowly averted closing but remains in bankruptcy. The operating unit of Caesars Entertainment, the owner of Bally’s Atlantic City and Caesars Atlantic City, filed for bankruptcy earlier in January. “No one should expect that the appointment of a very competent fiscal manager is the solution for Atlantic City,” said Peter Reinhart, professor and director of the Kislak Real Estate Institute at Monmouth University, as it would not solve the underlying problems of a stagnant tourism and casino industry. Atlantic City has some parallels with Detroit in the importance of casino revenues – Detroit’s reliance on casino cash to help fund a recovery was criticized during its restructuring process. Still, Detroit turned to its art collection to ease cuts to pensions as it climbed out of bankruptcy.

When asked about comparisons to Detroit, Orr said each place was different and “had to be taken on its own.”

(Additional reporting by Tom Hals, Lisa Lambert, Curtis Skinner, Megan Davies, writing by Megan Davies; Editing by Diane Craft and Christian Plumb)

Atlantic City bankruptcy talk ‘premature’: turnaround team

By Daniel Kelley and Hilary Russ