By Sarah N. Lynch

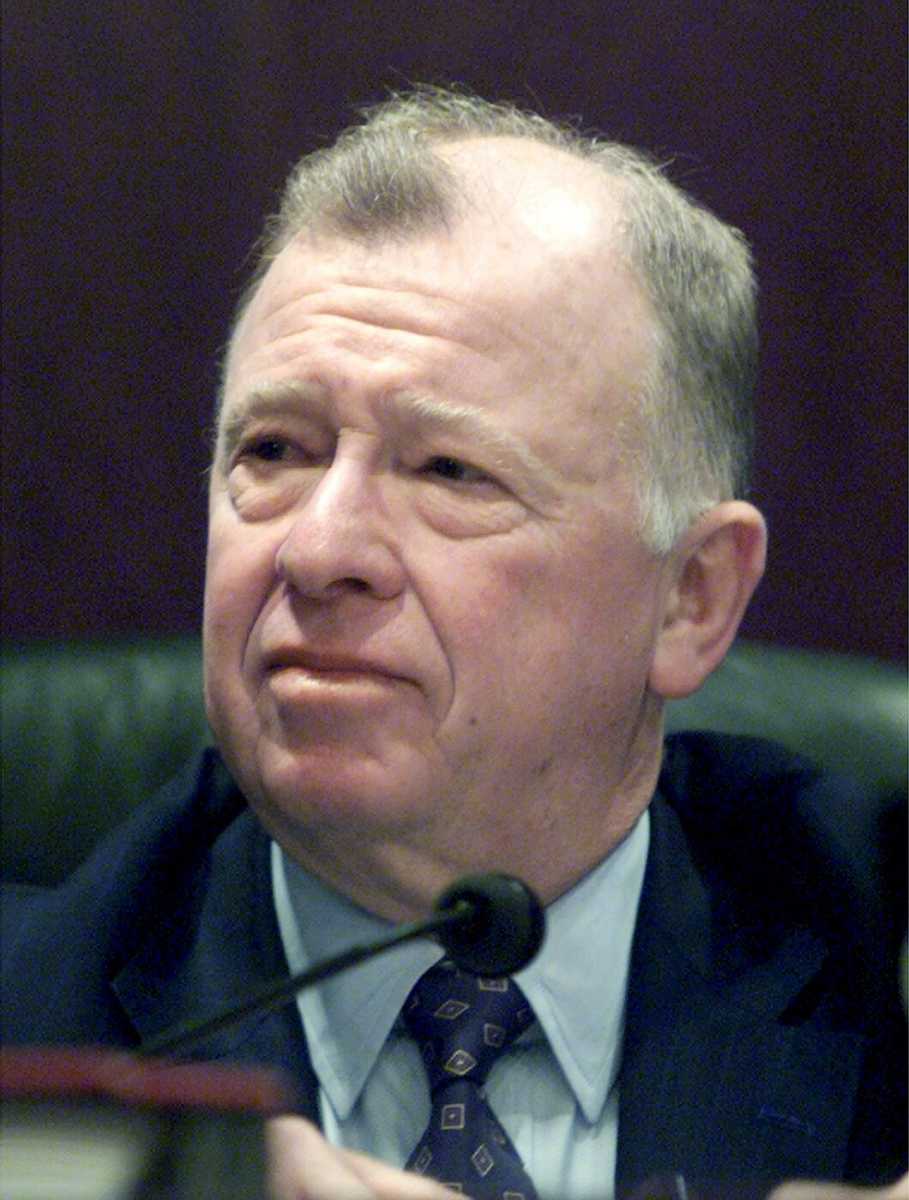

WASHINGTON (Reuters) – Former Securities and Exchange Commission member and prominent Columbia University law professor Harvey Goldschmid died on Thursday at the age of 74, the law school said. Goldschmid served as a Democratic commissioner at the SEC from 2002 to 2005. Before that, he also worked as the agency’s general counsel from 1998 to 1999, and served as a special advisor to former SEC Chair Arthur Levitt. During his SEC career, Goldschmid helped develop “Regulation FD,” a rule designed to prevent Wall Street traders from getting market-moving information ahead of other investors.

Goldschmid, known as a crusader for investor rights, was also in the running as a candidate for SEC chair in 2009, but President Barack Obama ultimately tapped Mary Schapiro for the job.

“Harvey was in a class by himself in terms of understanding the securities laws,” said Joel Seligman, the president of the University of Rochester and a leading expert on securities law. Seligman, who authored a tribute to Goldschmid in a 2006 Columbia Law Review article, described him as the most influential SEC commissioner in history who never rose to become chair.

Goldschmid’s SEC term coincided with the implementation of the 2002 Sarbanes-Oxley law, which Congress passed in the wake of high-profile accounting scandals at Enron and Worldcom.

He was appointed by President George W. Bush to serve at the SEC, first alongside Republican SEC Chair Harvey Pitt and later, Republican Chair Bill Donaldson.

Goldschmid was an outspoken critic at times, particularly during the acrimonious period surrounding Pitt’s appointment of former FBI head William Webster to run the then-newly created Public Company Accounting Oversight Board. Goldschmid and fellow Democrat Roel Campos were not told by Pitt about Webster’s role on the board of a company accused of fraud, and the two dissented on his appointment during a contentious public meeting. The controversy surrounding Webster’s appointment ultimately led both Pitt and Webster to resign from their posts.

After Donaldson was appointed as the new SEC chair, the tone at the commission softened a bit, and Donaldson and Goldschmid were able to find some common ground.

In what became known as the Donaldson-Goldschmid alliance, they, along with Campos, were able to push through a number of controversial rules over the objections of the SEC’s other two Republican members. Lynn Turner, a former SEC Chief Accountant under Levitt, said one of his favorite memories is when Goldschmid stood up to one prominent policymaker during a meeting to discuss loan losses.

In the meeting, the policymaker remarked that it shouldn’t matter if the banks were allowed to “fudge their numbers a little bit,” according to Turner.

“Harvey quickly turned to me and said – ‘Lynn, let me take this one.’ He then proceeded to eloquently and calmly explain to all in the room why transparency in the markets is so important.” (Reporting by Sarah N. Lynch; Editing by Christian Plumb)

Former SEC commissioner Harvey Goldschmid dead at 74

By Sarah N. Lynch