A lowdown on those MBAs

Business school students are taught to think in terms of ROI — return on investment. So what’s the ROI of business school?

According to a survey of last year’s executive MBA grads at Temple University’s Fox School of Business, the answer is clear: On average, the students saw a 62 percent increase in salary at their jobs after completion of the program, and 41 percent of the class received a promotion.

“Getting an MBA is absolutely worth it,” says Christine Kiely, assistant dean at Fox. “The job market is tighter, and the more skills you have, the more valuable you become.”

And if an employer has to “thin the herd,” Kiely says, those with advanced business skills are more likely to still have a job.

An MBA covers everything you need to run any type of organization, including finance, management and marketing. In addition to the core courses, students can pick a concentration, such as international business or real estate.

Full-time MBA programs tend to attract younger professionals willing to give up their jobs and head back to school for two years. Executive MBAs are part-time programs geared towards those who’ve been in the real world longer.

“The executive MBA is for older students who are happy with the trajectory their career is taking, but want some added skills,” explains Diane Sharp, director of marketing for the executive MBA program at University of Pennsylvania’s Wharton School. “They can go to class on Saturday, and apply the skills at work on Monday. It’s an immediate return on your investment.”

Get a taste of an MBA at Villanova’s unique program

Last spring, Villanova School of Business introduced the “mini-MBA,” a bite-sized business program designed for professionals who want to pick up some new skills without making a long-term commitment. The next mini-MBA meets over two weekends this fall, Oct. 22–24 and Nov. 6–7.

“It’s a sampling of what you would get in an MBA program,” says Robert Bonner, associate dean at Villanova. “Everyone’s looking for some kind of advantage — this gives you the advantage without having to invest the time and energy for a full-blown degree.”

Classes in the mini-MBA cover a range of management topics, including accounting, marketing and international business. And just like in a regular MBA program, plenty of time for networking is built in, too.

About 25 to 30 people are expected to attend the upcoming session — small enough to allow for engaging discussions, but big enough to have students bring in expertise from a variety of industries, says Rachel Garonzik, director of graduate recruitment and marketing. The mini-MBA also attracts professionals who want to test out what it’s like to be back in the classroom. Almost half the attendees from the spring session wound up going for the “full-blown” degree. To ease that transition, mini-MBA participants who plan to enroll in one of Villanova’s MBA degree programs, or have already enrolled, can complete a take-home case study for credit towards the degree.

“Students who came into the degree program after the mini-MBA said they felt more prepared,” Bonner says.

What exactly do you study when you study business?

The primary areas of a business curriculum are accounting (money), management (personnel) and marketing (products or services). Every business program will require familiarity with all three, plus specialization in one.

Accounting deals with recording and reporting financial information. It is detail-oriented and requires good math skills and the ability to interpret data. Accountants handle data within the organization. Finance experts interact with decision-makers outside the organization, such as banks, government agencies, stockholders and suppliers. The newest field in accounting is forensic accounting, which looks for financial data that might be used in legal cases.

Management deals with the organization of a business — deploying its resources, both people and materials. Because managers serve as team leaders, they need excellent interpersonal skills and must be able to function decisively and logically. Management Information Systems, or MIS, is the glamour area of management these days. MIS professionals bring together the traditional concerns of managers with the technological savvy of the IT staff.

Marketing, there’s more to it than just promotion. It involves researching the market to identify clients and customers and to discover their needs, as well as strategizing ways to meet those needs. Marketing majors thus need both the mathematical skills of accountants and the interpersonal skills of managers. The latest specialty is digital marketing — using social media like Facebook to reach, and respond to, customers.

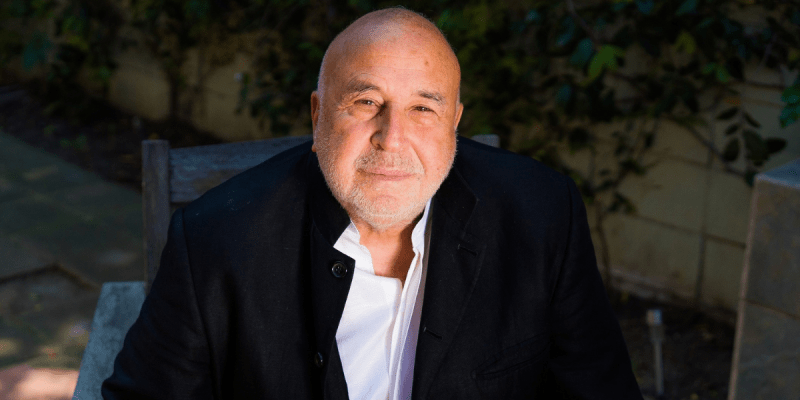

New law targets CPAs

Number crunchers, take heed: A new licensing law is catching Pennsylvania up to the rest of the country. Starting Jan. 1, 2012, aspiring certified public accountants are required to have 150 hours of higher education, including 36 hours in accounting and auditing as well as business law, finance or tax — which means the average undergrad working toward an accounting degree will come up short.

To make up the difference, Temple University’s Fox School of Business is adding a Master of Accountancy (MAcc) program. The MAcc, combined with a bachelor’s degree in accounting, totals 150 hours.

Students working toward the master’s degree spend four weeks each semester preparing for the CPA exam, and are encouraged to take two or three parts of the four-part exam while in the program.

“CPA firms that recruit our students love the exam component of our program — they’re excited that our students will have already passed part of it,” says Sheri Risler, MAcc director. “When our students get hired, they get very busy, very quickly, and it’s much harder to take the exam at that point.”

In addition to advanced-level accounting courses, the MAcc covers ethics and communication skills, including writing. “It’s common everywhere — accounting students are used to cranking out numbers, and they’re great at that,” Risler says, “but CPA firms tells us they don’t have any writing skills.”