Philadelphia City Council took a historic step Thursday by making Philadelphia the largest U.S. city to ever embrace a tax on soda.

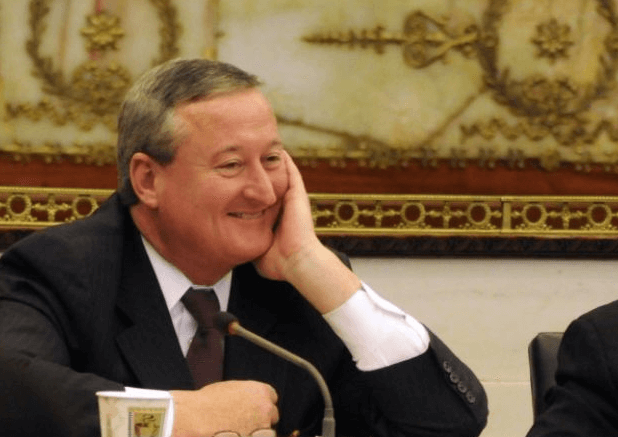

The 1.5-per-ounce tax pitched by Mayor Jim Kenney, intended to fund an array of city programs and estimated to bring in more than $90 million a year, formally passed City Council at its final session before summer recess. It is set to go into effect on Jan. 1, 2017. Kenney admitted after the victory that he was “a little tired,” but also “gratified,” saying he believes voters “want pre-K for their kids.”

“Anybody that says pre-K is babysitting is either a liar or a fool because it is not that it is not that at all,” Kenney said after the vote. “It is kids sponging information, at three years of age, when they’re prefect and pristine and they don’t see race and they want to come and hug you and have you hold them. It’s a wonderful experience.” Kenney said the tax, which applies to any sweetened beverage, including soda and diet soda,will “make quality, affordable pre-K, community schools and systemic improvements to parks, rec centers and libraries a reality.” Approximately $40 million of the estimated revenue is also set to go to the city’s general fund.

But an anti-soda tax coalition vowed to fight the tax in court, on the grounds that soda tax constitutes a sales tax, which only can be issued by state legislators.

“This tax is unconstitutional, and that’s why we will take this fight to the courts,” said Philadelphians Against the Grocery Tax in a statement. “Working families and small businesses simply cannot afford to pay this tax. And as we have seen in repeated 11th hour revelations from the Kenney Administration, the people of Philadelphia did not get the full story on where this money will go. After months of promoting pre-K as the reason for the new tax, we learned at the last minute that less than half of the tax money will actually go toward funding pre-K.” Kenney predicted victory in the legal fight.

“They spent millions on TV advertising … they will probably outgun us on lawyers, but I think the law is on our side,” he said.

City Council voted 13-4 in favor of the tax. Council’s three Republican members and Councilwoman Maria Quinones-Sanchez voted against the tax.

The Philadelphia Republican Party declared the passage of the tax a “shame.”

“It’s shameful how little the Democrats on Council listen to their constituents. You saw the citizens lining up in testimony against this regressive beverage tax,” Joe DeFelice, Chairman of the Philadelphia Republican Party, said in a statement. “If you think they’re angry now, wait till their grocery bills go up. Yes, this will obviously fall on the poorest the most. Yes, people are going to be angry about it.” But supporters of the tax said the revenues will go toward badly needed investments.

“The city stands ready to implement the most significant anti-poverty initiatives in more than a generation, including: funding for 6,500 new pre-K seats citywide over the next five years; creating 25 community schools where an array of health, behavioral and social services will ‘wrap around’ the educational program to improve academic success for students; and launching a $300 million investment to renovate rec centers, parks and libraries in neighborhoods throughout the city,” said Philadelphians for a Fair Future, a coalition of 81 local groups that support the soda tax, in a statement. Philadelphia Federation of Teachers president Jerry Jordan praised the passage of the soda tax.

“We cannot overstate the value of quality early childhood education,” Jordan said in a statement. “Children who have access to pre-k programs not only perform better in grades K-12, but are also more likely to attend college, and less likely to fall victim to the school-to-prison pipeline.” The only other city in the nation to have a soda tax is Berkely, California.

Philadelphia first big U.S. city to pass a soda tax

Getty Images