A friend told Felicia Pierce about MV Realty’s Homeowner Benefit Program when Pierce could not afford a bathroom repair.

The firm, in its pitch to the public, offers a check, typically between $400 and $700, in exchange for the homeowner agreeing that, whenever they decide to sell the property, MV Realty will be the listing agent.

Pierce didn’t mind that; she was planning to move soon anyway. She received disability payments and needed a place that was more accessible.

Testifying before City Council on Wednesday, Pierce said nothing in MV Realty’s paperwork indicated the length of the contract – 40 years.

“I read that contract from beginning to end. I never saw nothing about a 40-year contract,” she said. “No way would I enter into a 40-year contract for $465.”

Minutes before Council’s hearing, the Pennsylvania Attorney General’s Office sued MV Realty, accusing the Florida-based company of scamming at least 500 Philadelphia residents and using deceptive practices to violate the state’s Consumer Protection Law.

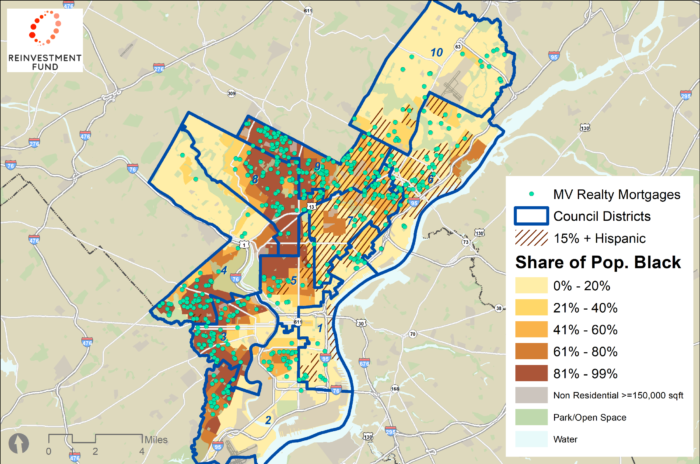

Advocates who have been speaking with MV Realty’s clients say the firm has targeted homeowners in low-income neighborhoods with high Black and brown populations.

Nearly 70% of those who have enrolled in the Homeowner Benefit Agreement in Philadelphia are Black, according to an estimate by the Reinvestment Fund, which analyzed and mapped MV Realty’s deals.

The contracts are usually signed in haste, the AG’s lawsuit says, with the firm sending notaries out to finalize the agreement within hours. In many cases, they did not leave residents with copies of the paperwork, said Kerry Smith, an attorney with Community Legal Services.

Homeowners must pay an early termination fee equal to 3% to 6% of their property’s value if the real estate is transferred, and the exclusivity rights extend to heirs if the owner dies. To enforce the terms, the company takes out a mortgage against the property.

Many of MV Realty’s clients did not learn of the mortgage aspect of the agreement until they received a notice from the city, according to the lawsuit, and the mortgage can act as a lien, making it harder to refinance or take out a home equity loan.

During Wednesday’s Council hearing, Rodney Thomas said he received a $365 check from MV Realty in the mail and was told to call to “activate” it.

Not long after, he suffered congestive heart failure, and, in the midst of a two-month hospitalization, he decided to sell his home and possibly relocate to a senior center.

Thomas said he forgot about his deal with MV Realty and had agreed to sell the home for $120,000 when he was served with court papers. The suit, from MV Realty, forced him to cancel the sale, he told Council.

MV Realty has sued at least six Philadelphia homeowners for attempting to sell their properties through another broker, the AG’s Office said. That process complicates the home’s title and stalls the selling process, the state’s attorneys wrote.

An MV Realty spokesperson, in an emailed statement, told Metro that the firm has not engaged in unfair or deceptive practices, adding that the company is confident that the Home Benefit Agreements are “in full compliance with Pennsylvania law.” Agents always conduct “transparent dialogue,” the spokesman said.

MV Realty has dispersed more than $1.1 million to Pennsylvania clients, according to the company.

“New and innovative business models, like the HBA, can transform established industries and can sometimes draw questions from critics or outright hostility from those whose existing business model is threatened,” the statement added.

The agreement, the AG’s Office argued in its lawsuit, is “far outside the standard practice for the real estate industry, and no reasonable consumer would expect to see these provisions in a contract with their real estate broker.”

MV Realty is headquartered in Delray Beach, Florida, and its founder is Amanda Zachman, a former contestant on season 15 of the popular reality show “Big Brother.” She is named in the AG’s suit.

The AG’s Office, which filed its case in Philadelphia, has asked the court to order the company to pay restitution to the scheme’s victims; strike all mortgages; discontinue offering home benefit agreements; and pay a civil fine.

Prosecutors in Florida and Massachusetts have also recently sued MV Realty, which operates in more than 30 states.

Anyone who believes they were scammed by the firm can file a complaint with the Pennsylvania Bureau of Consumer Protection by contacting 1-800-441-2555 or scams@attorneygeneral.gov, or by going to www.attorneygeneral.gov/submit-a-complaint.

Metro is one of more than 20 news organizations producing Broke in Philly, a collaborative reporting project on economic mobility. Read more at brokeinphilly.org or follow on Twitter at @BrokeInPhilly.