By Nandita Bose and Lisa Baertlein

WASHINGTON – President Joe Biden is pushing to ease supply shortages and tame rising prices in time for Christmas, but unsnarling U.S. supply lines could take far longer, experts told Reuters.

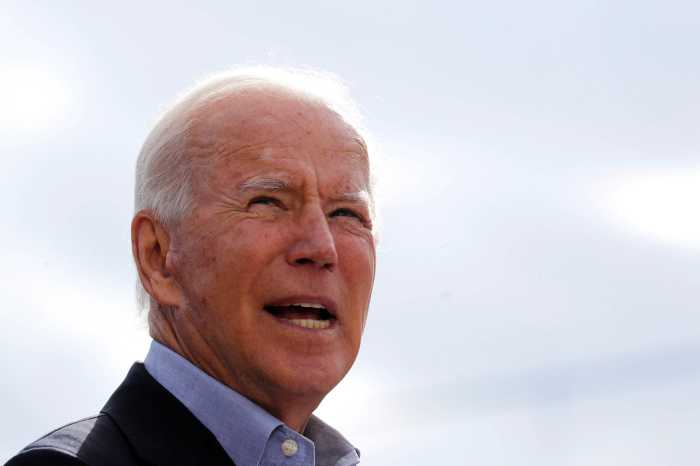

Biden brought together powerbrokers from ports, unions and big business on Wednesday to address shipping, labor and warehousing pain in the U.S. supply chain, and announced new around-the-clock port operations in Los Angeles.

As his Republican opposition seizes on possible Christmas shortages to connect Biden’s economic policies to inflation, and try to stall a multitrillion-dollar spending bill in Congress in coming weeks, the White House’s message Wednesday was that a solution is in sight.

“This is an across-the-board commitment to going to 24/7,” said Biden, a Democrat. The port opening, and a promise from retailers like Target and Walmart to move more goods at night are a “big first step,” he said. Now, he said, “we need the rest of the private sector chain to step us as well.”

While more cooperation among the often competing, secretive players in the U.S. supply chain business is a plus, the White House’s impact may be incremental at best, logistics experts, economists and labor unions warned.

“What the president’s doing isn’t going to really hurt. But at the end of the day, it doesn’t solve the problem,” said Steven Ricchiuto, U.S. chief economist at Mizuho Securities.

Americans, already by far the world’s biggest consumers, have simply been buying a lot more stuff during the pandemic, much of it imported. Couple that with labor shortages, equipment shortages and a lack of space to store that stuff, nationwide.

Players from ports to retail chains are already working full-tilt to handle the pandemic-fueled surge in imports and get holiday gifts onto shelves and e-commerce centers in time for the Nov. 26 Black Friday kickoff of the 2021 holiday season.

Imports at the Port of Los Angeles – the No. 1 gateway for ocean trade with China – are up 30% so far this year over last year’s record.

But that has left some 250,000 containers of goods stacked up on the docks due to delayed pickups, from chassis shortages and a lack of space in rail yards and warehouses. And that is causing dozens of ships to back up at anchor outside the port.

“The analogy would be the boa constrictor that ate the mouse. There’s a lump in it and the lump is the constraint in the throughput of the supply chain, and it moves along each time you solve for a constraint,” said Joe Dunlap global head of the supply chain advisory team at CBRE Group, a commercial real estate services firm.

‘YOU DON’T BUILD A CHURCH FOR CHRISTMAS’

Frank Ponce De Leon, International Longshore & Warehouse Union Coast Committeeman summarized the problem at U.S. ports, which the Commerce department estimates handle 76% of all trade, during comments last week.

“You don’t build a church for Christmas and Easter; you build it for a regular Sunday service,” he said. “With the unprecedented influx of cargo, it’s like Christmas and Easter on the docks every single day, with more ships coming in and the pews have been full for months, and there’s nowhere left to sit – or stand.”

Dockworkers remain available for 24-hour shifts to help clear the port backlogs, the longshore union said. But that is not true of the people who move goods from the ships or from ports, other unions say.

“One of the major problems with the current state of logistics is the shortage of port truck drivers. They are not paid a living wage,” said Teamsters General President Jim Hoffa, who participated in the meeting with Biden.

The backup may be exacerbating that shortage, because many port drivers are not paid for the hours they spend waiting to pick up a container, making the job less appealing.

Still, there is no evidence experienced workers are sitting on the sidelines – U.S. transportation and warehousing are employing more people now then they did before the pandemic started, data from the Bureau of Labor Statistics show.

WAREHOUSES OVERFULL, UNDERSTAFFED

Like seaports, warehouses work best when they are moving products in and out quickly and predictably. Instead, port officials say, they are packed to the rafters and struggling with employee hiring and retention.

U.S. companies are leasing warehouse space at record levels to handle the large influx of goods for e-commerce.

The markets that serve Southern California ports include Los Angeles and the Inland Empire region nearby, which had second-quarter vacancy rates of 1.2% and 1.4%, respectively, according to CBRE data.

“Space is clearly tight,” Dunlap said.

It is not just that warehouses are at capacity, Steve DeHaan, CEO of the International Warehouse Logistics Association, said in a recent letter to John Porcari, port envoy for the White House Supply Chain Disruptions Task Force.

Warehouse owners, tenant and workforce employers can be different companies, which makes drawing up new contracts to pay round-the-clock workers difficult. “The warehouse cannot arbitrarily make this decision,” DeHaan said.

Moving a warehouse to 24/7 operations adds another layer of risk, he said.

“For example, receiving a container at 6 a.m. that was scheduled for 3 a.m. delivery disrupts operations for the entire day,” DeHaan said. “The goal of reducing container congestion over the next 90 days is ambitious.”