By David Lawder

WASHINGTON – Corporate tax advisers are warning clients not to celebrate the apparent demise of President Joe Biden’s $1.75 trillion climate and social spending package, which they say could be resuscitated with a similar price tag and proposed tax hikes.

Any changes in a new version of the bill negotiated between Biden and his fellow Democrat, U.S. Senator Joe Manchin, are likely to focus more on the spending side than on revenue-raising measures, said Ryan Abraham, a principal with Ernst & Young’s Washington Council advisory practice.

The bill’s revenue measures include higher taxes on companies and the wealthiest households.

Over the weekend, Manchin shocked the White House when he said in an interview on the “Fox News Sunday” program that he would not support the spending package. The moderate Democrat has expressed concerns about its impact on inflation as well as measures such as the expansion of the child tax credit program.

But Manchin, who represents West Virginia, one of the poorest states in the country, has continuously said he supports increasing taxes on corporations and the wealthy and reversing some of the Trump administration’s 2017 tax cuts that he opposed.

“I don’t know whether outside of the child tax credit and some discreet changes that Manchin needs, that much, really, on the tax side is going to change. That doesn’t seem to be where his biggest concerns are,” Abraham told Reuters.

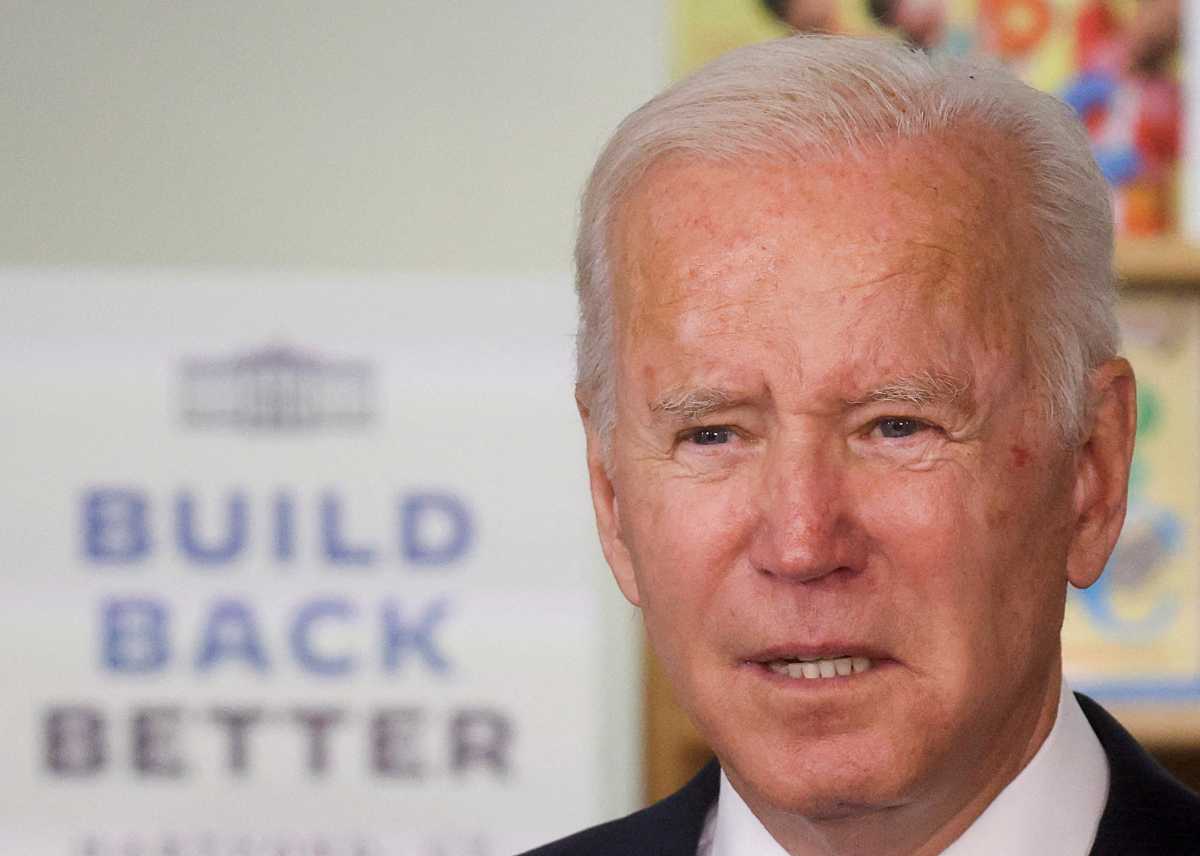

The revenue measures in Biden’s “Build Back Better” bill, which include a 15% minimum tax on corporate book income, a higher 15% minimum tax on overseas corporate income and a surtax on individual income above $10 million, may still be needed to ensure that whatever emerges from new negotiations covers the costs, Abraham said.

Some tax breaks, such as a deduction for U.S. union-made electric vehicles, could be dropped, while green energy goods makers and other industries may be exempted from the book income tax.

GLOBAL CORPORATE MINIMUM TAX

Two days after Manchin dealt the legislation what appeared to be a body blow by publicly rejecting its latest version, Biden said on Tuesday that he and the senator were “going to get something done” on the legislation.

A Manchin aide on Wednesday had no comment on the talks.

“Our first piece of advice is that it’s not over until it’s over,” said Manal Corwin, a former U.S. Treasury official who is now head of KPMG’s Washington National Tax practice. “The motivation to get something done is pretty strong, even if it has to get pared down.”

Even if Biden’s White House is able to get Manchin to support the “Build Back Better” bill, it will still have to win over Democratic Senator Kyrsten Sinema to pass it in the 100-seat Senate, which is narrowly controlled by the Democrats. Sinema and all 50 Republican senators have rejected higher corporate tax rates.

The current tax provisions, crucial to a deal among 136 countries for a 15% global corporate minimum tax, are less controversial and are likely to survive in a revamped version, Corwin said.

“From a global tax perspective, it’s really about whether they are successful getting a deal or not” to allow the package to win approval, Corwin said, adding that Manchin’s announcement over the weekend is “raising alarm bells” in some countries about U.S. Treasury Secretary Janet Yellen’s ability to deliver on her promises.

A Treasury spokesperson said on Wednesday that the department was confident it could meet the commitment to implement the 15% global corporate minimum tax next year, with the rules coming into force in 2023.