City Council, during their first chance to publicly question Kenney administration officials about the mayor’s budget proposal, challenged his plan to lower taxes and spread out federal relief dollars over several years.

Several members suggested that the city use a greater share of the $1.4 billion in federal funding over the coming months to speed up Philadelphia economic recovery from the COVID-19 pandemic.

“If there ever was a time for us as a government to be bold and bolder and change the trajectory of our city now, this is it,” Councilman Alan Domb said during a virtual hearing Monday morning.

The injection of cash, part of President Joe Biden’s American Rescue Plan, saved the Kenney administration from having to consider tax hikes or city employee layoffs to close what was projected to be a $450 million budget deficit.

His proposed spending plan calls for $575 million in ARP money to be spent in the 2022 fiscal year, which begins July 1, with $425 million earmarked for the following year and a combined $393 million for fiscal years 2024 and 2025.

“We took a specific track of trying to ensure that the city could provide and expand the services that we could provide and to do so with a balanced budget for five years,” Jim Engler, Kenney’s chief of staff, told Council.

Councilwoman Helen Gym asked why the administration is pushing for decreases to the wage and business income and receipts taxes instead of directing more money to minority-owned businesses in the form of targeted grants.

Kenney’s proposal is the largest cut to the wage tax in a decade and would bring the rate to its lowest in 50 years, officials said.

A household in the city making $45,000 would save an extra $14 to $15 a year, according to Marisa Waxman, the city’s budget director.

“Our businesses absolutely need a front-end investment right now, and I do not understand the pursuit of broad-based tax cuts,” Gym said.

Representatives from the mayor’s office said the city is attempting to move away from its long-time reliance on the wage levy, which must be paid by anyone who lives or works in Philadelphia.

Compared to property taxes, it’s a much more volatile source of revenue. About 40% of the tax is paid by commuters, and the Kenney administration is projecting that 15% of those people will continue working remotely, resulting in a $100 million a year hit.

Rob Dubow, the mayor’s finance director, said the city expects to pay $100 million in refunds for non-residents this fiscal year and another $70 million next year.

The wage and BIRT taxes are also viewed as barriers to economic growth, Waxman said.

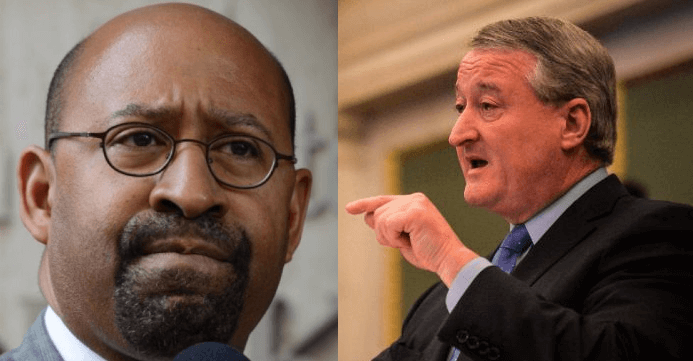

Council President Darrell Clarke said the focus needs to be on making sure Philadelphians are able to access high-paying office jobs and other employment opportunities.

“You want to live in the suburbs? That’s all fine and well. This is America,” he added. “But I got to tell you, that I really want that job you currently have, that you’re working remotely, to go to a person who lives in the city of Philadelphia.”

In addition, there was repeated questioning about support for minority-owned businesses.

A report released in August showed that Philadelphia lags far behind Boston, New York, Atlanta and Washington, D.C., in the number of Black-owned businesses per 1,000 Black residents. Those businesses also make less money than firms in the other cities, the study found.

Councilman Derek Green said he doesn’t see “the investment and commitment” in the mayor’s plan to grow wealth in Black and brown communities.

Two other members, Jamie Gauthier and Kenyatta Johnson, said next year’s budget needs to incorporate more money for anti-violence initiatives.

“I definitely know for a fact that the number one issue that everyone is concerned with right now is gun violence,” Johnson said.

Kenney’s plan would devote $35.5 million to non-police programs aimed at reducing gun violence, more than doubling current levels of funding for such initiatives.

Council will hold a series of hearings over the few weeks month examining each department’s budget. The first public comment session will be held Wednesday at 3 p.m.

The city is required to adopt a balanced budget before the end of June.